Rotation Takes A Breather As Market Over-reacts To CPI

- Scott Poore, AIF, AWMA, APMA

- Mar 18, 2024

- 2 min read

Markets reacted to a slightly higher inflation number than expected.

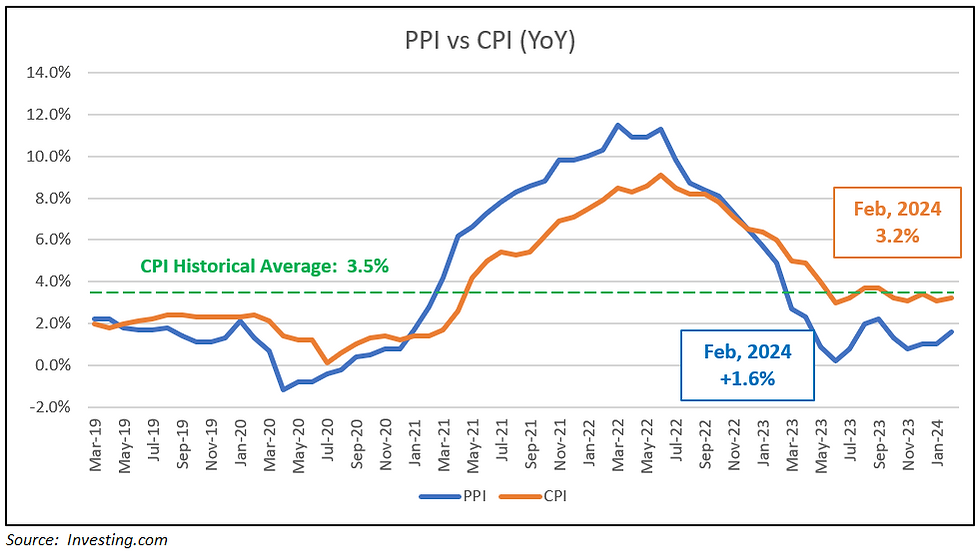

The February Consumer price Index came in as expected on a month-over-month basis, but inched higher to 3.2% from 3.1% on a year-over-year basis. While the February reading is still below the historical average of 3.5%, the market saw the possibility of a May rate cut by the Fed dissipate. Current futures on the next Fed Rate cut dropped to just a 53% probability in June. Back in December, the Fed's "Dot-Plot" showed that at least 4 Fed members saw at least 4 rate cuts this year. The market is now pricing in just 3 rate cuts, which is why February's CPI number caused so much havoc last week. In reality, what it means is that the economy is healthy enough that fewer rate cuts are needed.

The consumer is still strong as Retail Sales for February, while lower than expected (+0.6% vs +0.8%), were much stronger than January's reading of -1.1%.

Jobless Claims are well within normal ranges, which means the consumer can afford to keep spending. The current bull market is being compared to prior periods like 1999 and 2007, which were just preceding economic recessions. However, going back to 1957, current performance from the market bottom is below the median bull market and well below the most aggressive bull market. In fact, in corporate earnings calls this quarter, the fewest number of companies cited "recession" since 2021. The FOMC meeting is likely to make trading interesting this week.

Disclosures

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Comments